In part 1 of this little literary gem I shared my background and where I have been over the last thirty seven years. If you have not read it, please, really… the first 400 pages really moves fast. Hahahahaha. I crack myself up.

Let’s talk about the present now and on what I my focus my professional career; and how that I might be able to help you you. I guess if you really wanted to boil down my work; I do two things really well.

- I help people save as much money as possible. Whether that is by cutting healthcare expenses,

I am an independent, licensed and appointed, health and life insurance broker.

What does this mean? I know it’s a mouthful. Let’s break it apart. First, it means I am independent. I am not captive to one particular company, presenting their products. I can remain objective. I represent many, many companies. This is the great thing about being an independent broker. I can remain on YOUR side and not one particular company’s side. It also means that I have no boss. I have no one putting “sales quotas” on my back; no one pressuring me to sell, sell, sell. I hate that crap. I am not much of a sales person I presume.

I just hate feeling like I have any kind of agenda that is not directly tied to what someone has told me they need, or that solves a problem I know they have. Even though some times people do not know when they have a problem, and it is staring them right in the face.

So, I spend a lot of time reading, learning, and educating myself. I am always looking for ideas that will benefit the 100’s of clients I serve. Sometimes, I will find small solutions. Sometimes I find something HUGE! I love those days. LOL

Second, I am a licensed and appointed. I am licensed by the state of Kentucky’s Department of Insurance (Lic#814418) to be a health and life agent. This means I am continually being tested and I maintain professional insurance, bonding, and educational requirements for both the life and health insurance industries.

I am appointed; meaning that within the scope of those industries, companies have investigated me and have contracted with me to represent them. MOST importantly, these are companies that I chose. These are the companies I believe are the best in the industry at what they do. I stand always committed to these companies and each year, I go through a series of certifications and recertifications for nearly all of them.

Health Insurance Appointments for 2018

- Humana

- Anthem Blue Cross/Blue Shield

- Mutual of Omaha

- Cigna

- Guarantee Trust Life (GTL)

- Aetna

- Gateway

- SilverScripts

- UnitedHealthOne

- Golden Rule

- Delta Dental

- Bright Idea!

Life Insurance Appointments for 2018

- Humana

- Anthem Blue Cross / Blue Shield

- Ameritas

- Protective Life

- Security Life Insurance

- Transamerica

- Phoenix

- PHL Variable Insurance Company

- and several others in process

This means that I help people with all sorts of healthcare insurance relation’d needs, as well as, I help them plan and save for and spend their retirement dollars. I love financial planning as a whole. The people I still see from the 80’s when I was with Dean Witter Reynolds still like to tell me what a service I performed by having them invest in Phillip Morris, Occidental Petroleum, McDonald’s Corporation, zero-coupon treasury bonds, and a variety of 7% triple-tax-free bonds. Boy, those days are long gone, and those bonds have long-matured.

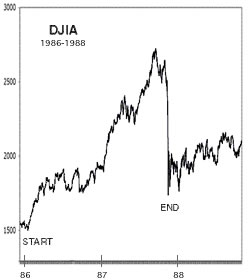

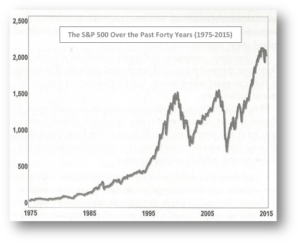

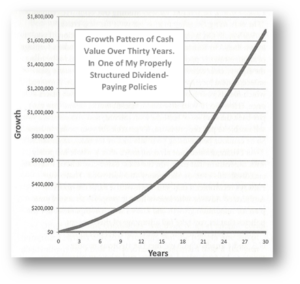

I did so enjoy the investing world; when it was suitable. I just don’t think the stock market is safe any longer; not for people my age and above. It’s just too manipulated against the small time investor. I think I prefer to stick with a little more conservative investments.

And so, this is where I am now. I returned to this business some six years ago as mentioned in part 1… because I could see that with the “baby boomers” coming of age, they were going to need a lot of help. The boomers need solid advisers to help them with healthcare and retirement planning in this uncertain age.

So, that’s what I do. I do it for myself and I do it for all the people around me since they are all my age and above. I help people “figure it out”. I help them save. I help them shelter. I help them avoid unnecessary taxation. I help them avoid unnecessary healthcare expense. I do what I can. A lot of times it is just too late for me to do much.

When I meet with a “turning 65” year old and they look worried about a $32/month Medicare plan because they are not sure if they can afford the premiums, well I know I have someone that is going to have even a much harder time down the road if they should become sick, and have $1,000’s of dollars in healthcare expenses that the plans do not pay for. Oh yah. That happens every day.

Or when I get the call from a client asking me what the cost is for $10,000 in “final expense” insurance. Well, this is someone that has struggled probably all their life. They were not even able to plan for their last expenses until the very end, when it was the most financially difficult? I see it all the time.

It’s very hard on me. Here is a rule of thumb for you to consider; and I pray that you listen to me on this, and learn from the lesson.

The harder the sell by your insurance adviser; probably the better the product is; whatever it is… for you.

For instance, let me tell you some of the products that are the hardest to convince people they need.

Critical Care Insurance – This is very specialized coverage that ALL of us need to protect us in the event we come down with one of the big three (Do you know them? Heart attack. Stroke. Cancer.) Did you know that these three combined are the cause of death for about 70% of seniors that do not die from some type of accident?

So, what did I just tell you? Basically, IF you live to be 65 years old, that more than likely (70%) when you die it might be because of heart attack, stroke, or some form of cancer.

The big 3.

There are these truly wonderful policies that will pay you money if you are ever diagnosed with one of these three. You do not have to die from it… just be diagnosed. And yet, people do not want to spend the money for these policies. It’s just not relevant. Well, not until they feel a breast lump; or a man finds blood in his urine. Then they start wondering and asking questions. Too late. You have to get insurance before you get the illness! People always seem to forget this fact.

Lord help me, if you have one of these in your family tree somewhere, you need one of these policies. Watch a short video by Dr. Marius Barnard, the South African physician that invented the industry more than twenty years ago. It’s excellent.

Imagine finding out that you have Cancer; calling your insurer and they send you a check for $50,000 to put in the bank, pay yourself, while you fight the illness. How glorious.

Imagine having a heart attack and they actually SAVE you. It happens all the time these days; largely due to the fact we are so connected real time through cell phones and the internet, and there are such really good drugs that the paramedics and administer now… raise your heart rate, slow your heart rate. They can nearly make you even do flips if they want. So, good news… they can save your life. And after the hospital sends you a bill for $50,000 for doing so (even if you have decent insurance), you can throw that on the pile you have received from everyone else, because you cannot go back to work right away. Right?

See? That’s the problem. Even if you have insurance, you still have healthcare expenses at the same time that, guess what, you CANNOT WORK. So, you can’t kill it at the J-O-B cause “it” nearly killed you, and at the same time, the bills are mounting.

Is it any wonder that medical expenses are the largest contributor to bankruptcy cases these days?

Don’t even get me started on the need for quality Long-Term Care coverage. Very, very expensive. I just priced a policy for my girl friend and myself. Are are both around 55 years old and for a really good policy, the cost is around $650 a month for the two of us. That’s a lot of money.

Part 1 – A Little More Than a Biography

Part 3 – Here Are My Plans for the Future

Attend an online class on a Saturday morning.

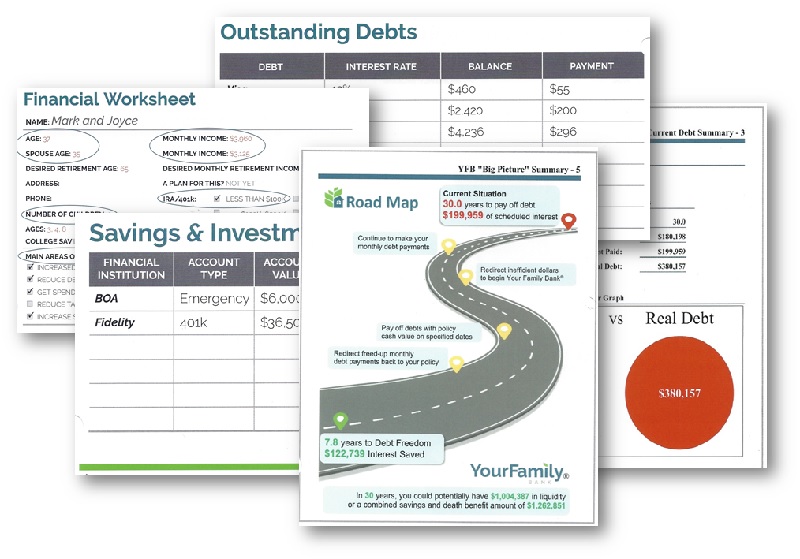

Attend an online class on a Saturday morning. A Big Picture Report will show you;

A Big Picture Report will show you;