St. Elizabeth’s Healthcare to Leave Medicare Select Network in Kentucky

August 20, 2015

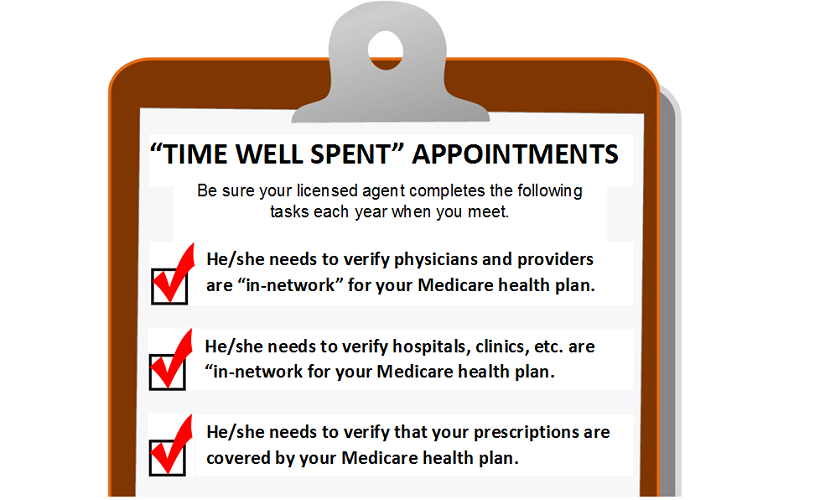

We at Anthem Blue Cross and Blue Shield (Anthem) are committed to providing our members with access and choice for their medical care. One way we do this is by contracting with hospitals and physicians to participate in our provider networks. We have been in negotiations with St. Elizabeth Healthcare in Northern Kentucky, and they have decided to end their participation in our Medicare Select network effective January 1, 2016.

There will no longer be Medicare Select facilities in the Kentucky counties of Boone, Campbell, Grant and Kenton. St. Elizabeth Healthcare has been a part of the extensive network for over 15 years, and we are clearly disappointed that they have made this decision. We will continue to talk with St. Elizabeth Healthcare in hopes of reaching an agreement.

St. Elizabeth Healthcare operates six facilities in Covington and other parts of Northern Kentucky:

| St. Elizabeth Covington 1500 James Simpson Jr Way Covington KY 41011St. Elizabeth Edgewood 1 Medical Village Dr. Edgewood, KY 41017 St. Elizabeth Falmouth |

St. Elizabeth Florence 4900 Houston Road Florence, KY 41042St. Elizabeth Ft. Thomas 85 N. Grand Ave. Fort Thomas, KY 41075 St. Elizabeth Grant |

We will be notifying our members by letter the first of September, which will include several options regarding their health coverage. We will also include in the mailing a listing of other Medicare Select plan facilities in KY and OH.

The health coverage options listed in the letter for the member are:

- Continue with the current Medicare Select coverage. Emergency services may still be provided at a St. Elizabeth Healthcare facility at the highest benefit level, but elective inpatient care should be sought at one of our other Medicare Select network facilities.

- Consider another Anthem Medicare Supplement Plan with equal or lesser benefits.

- Choose an Anthem or other Medicare Advantage plan during the upcoming Annual Election Period (October 15 through December 7).

Anthem has participating facilities in the Metropolitan Cincinnati area that your clients might consider using for elective inpatient admissions. Emergency admissions do not require network use for maximum benefits. See the links above for those providers in close proximity to the Metropolitan Cincinnati area.

At Anthem, we’re committed to helping you succeed. We know you are a huge part of our strength and success, and we value your trust and partnership.