Category: Tips

New Alzheimer’s treatment fully restores memory function

Source: New Alzheimer’s treatment fully restores memory function

Source: New Alzheimer’s treatment fully restores memory function

Excellent article on ALZ research and how close they are to curing it!

Bluegrass ADD – Pathways Resource Guide 2014 – 2015

Source: Bluegrass ADD – Pathways Resource Guide 2014 – 2015

A wonderful guide for seniors. Providers, services, ideas… all in there to assist.

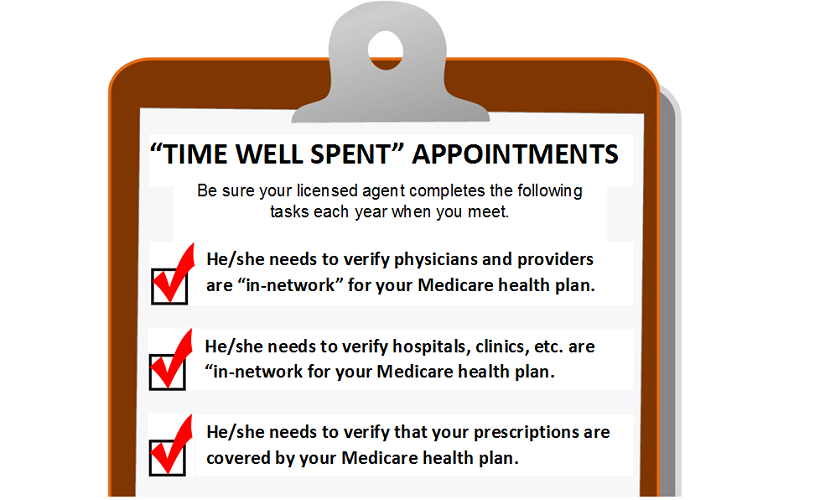

Medicare Reviews: “Time Well Spent” Appointments

HOW NOT TO WASTE TIME…

With zero doubt, we all want to be smart consumers and on the subject of Medicare, as a beneficiary, you have to know the facts each year to make sure you are saving the most amount of money possible on your healthcare costs. By knowing the facts, you can avoid some “surprises” when you need healthcare; namely unexpected costs.

Every year Medicare health plans change. Their premiums, deductibles, copays, coinsurance; all these things can change… your COSTS can change. Each year providers, facilities, and drugs enter and exit plans. Each year plans themselves enter and exit the marketplace.

Even covered procedures.

DO YOURSELF A FAVOR….

Call a professional; a licensed, experienced healthcare insurance agent or broker, and have them sit down with you and explain your options. A “broker” is the best possible option because they frequently represent multiple companies, rather than just a couple or even one. Brokers can remain unbiased and uninfluenced by individual plans because they remain independent. Sales agents working for one plan and want you to buy their plan. Right? An agent is not going to be paid if you choose their competition. Makes sense, right?

What you need is an unbiased professional that you can trust to sit down with you and help you double check your plans against all those being offered to make sure.

While they are there, you should have them verify your physicians and other providers status; that they are “in-network” for the plan you choose. Not that they accept the plan… because that can be misleading. They need to be “in-network” for your plan. This is especially important in HMOs. Providers are very often moving in and out of network for plans.

They need to also check your facilities. Your hospitals, clinics, practices to make sure they are “in-network” as well. You really do not want to pay “out-of-network” rates if you do not have to. See the chart below.

Checklist for how to save time and money. Make sure your adviser does these things when you meet with them.

IS ALL OF THIS REQUIRED?…

Heavens no.

Any agent; independent or not may be able to enroll you in a healthcare plan of your choosing if they are appointed and have certified with that plan on their product offerings. We do not even need your prescription list, provider list, etc. In fact, most agents don’t want to spend the time necessary to do all this research when they come to see you.

And, it’s important for you to know that, if you share that information with them, that it has NO IMPACT ON WHETHER YOU CAN ENROLL OR NOT… During the Annual Enrollment Period (AEP), you cannot be turned down due to poor health conditions. Everyone is accepted. The only purpose for sharing that information with your agent is so that he can evaluate what your possible healthcare costs will be for the coming year. It has nothing to do with ability to enroll.

THIS IS FOR YOU

The fact is our lives would be easier if we did not do all this research. Can you imagine. If I had 1000 clients for instance? Do I really want to look up maybe 10,000 drugs if each had 10?

No. This is not for us. Rather, this research should be our commitment to you. This is what I do for you that most will not. I want you to know all your facts so that you can make an informed educated decision, so that next year, you are not caught with a financial surprise!

THE BEST COURSE OF ACTION…

If you would like my help, then contact me. You can email me at toldfield@coolinsurancegroup.com or call me at 859.654.0120

To visit my “Contact the NINJA!” page, go HERE!

[bne_testimonials_slider “medicare”]

4 Incredible Things That Happen To Your Body When You Give Up Diet Soda : Healthypage

Starting a new diet almost always involves cutting calories, and for many soda lovers, that means switching to diet. You’ve probably already heard that diet soda is just as bad—if not worse—for your health as regular soda, but that may not be enough to convince you to give it up for good. So,

Source: 4 Incredible Things That Happen To Your Body When You Give Up Diet Soda : Healthypage

Elder Abuse in Nursing Homes — It Happens, Watch Out For These Big Signs

If you or someone you know has a loved one in a nursing home right now, it‘s important to stay alert — because you might not expect the level of neglect or abuse that can occur when you’re not looking. Here’s what we’re talking about: Death; Serious bodily injury such as stroke or paralysis; Severe pain and suffering; Medical negligence. If an elderly person you know suffered or passed away from any of the above while residing in a nursing home, you may be able to file a nursing home abuse lawsuit on their behalf. Death, serious bodily injury and significant pain and suffering may happen for a variety of reasons, including medical negligence — i.e., nurses or staff not calling doctors in when they are so desperately needed.

Source: Elder Abuse in Nursing Homes — It Happens, Watch Out For These Big Signs

6 Tips for Dining Out with Diabetes

Beyond Insulin: New Treatments to Keep Blood Glucose Under Control

Fifty-eight percent of adults with diabetes use oral medications and 12 percent use insulin. These treatments aren’t the only options.

Source: Beyond Insulin: New Treatments to Keep Blood Glucose Under Control

Articles » Could You Be Saving More?

While the trend toward longer, healthier lives is well-known, retirement planning is fraught with uncertainty. Research shows that over the past two decades expected retirement age has gone up. In 1991, 11 percent of workers expected to retire after age 65. In 2014, it was 33 percent, and 10 percent don’t plan to retire at […]

TIPS – Make Sure Your Doctor is “In-Network”

Are you receiving your Medicare benefits through a MedicareAdvantage PPO or HMO plan, OR, an “on-exchange”/”off-exchange” Obamacare or legacy healthcare plan? If so, be sure to do the following when seeing any doctor for the first time.

At the front desk or with your doctor’s billing representative, show your MedicareAdvantage membership card (from Humana or Anthem BC/BS or other) and ask them if they can verify that they are “in-network” for your plan. Do NOT ask them if they take your plan. Inevitably they will nearly always say they will “take your insurance and file it” for you.

This does not mean that they are in-network and could cause you to have higher copays, and/or you may not even be covered for the visit.

What you need to know is if your doctors are “in-network”. That is the key.