The federal government has told Republican Gov. Matt Bevin what he will need to do to shut down Kynect, the health-insurance exchange started by his Democratic predecessor, Gov. Steve Beshear, and the letter from the Centers for Medicare and Medicaid Services makes clear that it will be a complicated task.

Bevin has said Kynect performs no functions that can’t be handled by the federal insurance exchange, but Emily Parento, who ran the state Office of Health Policy for Beshear, says in an op-ed published in Kentucky newspapers the change might lead to “higher costs and less choice” for those who buy exchange policies.

In a Dec. 30 letter, Bevin gave formal notice to the U.S. Department of Health and Human Services that he plans to dismantle Kynect “as soon as is practicable.” Joe Sonka reports for Insider Louisville that the agency replied to Bevin in a letter dated Jan. 28 “outlining the steps that must be taken to do so before the enrollment period for next year begins.” A copy of the letter accompanies Sonka’s story.

Andrew Slavitt, acting administrator of HHS’s Medicare-Medicaid center, told Bevin, “Ceasing Kynect will create a number of challenges that must be addressed to ensure that access to affordable health coverage continues for Kentucky’s consumers.”

To “ensure a smooth transition,” Slavitt wrote, the state needs “a detailed plan for how Kentucky will continue to meet its obligations” to serve Kynect customers for the rest of 2016. While enrollment has closed, except for former customers of the failed Kentucky Health Cooperative, Medicaid enrollment is open year-round, and Slavitt said Kynect will still need to “process changes in circumstances or special enrollment periods for 2016 current and new enrollees.”

Bevin spokeswoman Jessica Ditto told Sonka, “The letter from HHS is a fair representation of the expectations that were communicated to us regarding the process moving forward. We are in active and ongoing communications with CMS and are working collaboratively to ensure a smooth transition to the federal exchange.”

The letter from CMS notes that if insurance companies plan to offer Kentucky policies on the federal exchange, they must apply to that exchange this spring, probably from April 11 to May 11, Sonka reports.

Kynect Director Carrie Banahan said in August that fewer companies might participate if they had to offer plans through the federal exchange, and Parento made a similar argument in her newspaper op-ed, noting that insurers offered 60 plans through Kynect in the latest enrollment period, half again as many as the 40 offered in the previous year. She said that was “a direct result of the effective work of the team at Kynect, in working with insurers.”

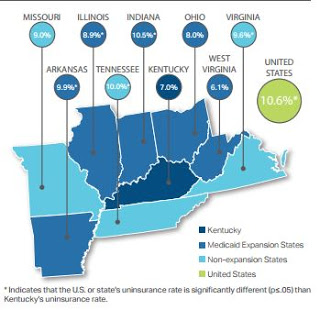

Parento also argued that Kynect has saved customers money, because it has “the lowest median premiums among surrounding states (plus Arkansas) for silver-level family plans, the most widely selected level of plan. The average premium in those states was nearly 10 percent higher — approximately $642 per month compared to Kentucky’s rate of $585 per month. . . . Among all of those states, Kentucky is the only one with a state-based exchange.”

The federal government gave Kentucky $289 million to create Kynect, but the state has almost $58 million of the grants remaining. Slavitt told Bevin that the state will have to return the money — and “will have to cover the costs of setting up its own system to enroll” people in Medicaid, Sonka reports.

Emily Beauregard, executive director of Kentucky Voices for Health, a coalition of health-reform advocates, told Sonka that the loss of “kynectors” assisting consumers on the state exchange “could limit access to coverage for those who need it the most” because 430,000 Kentuckians enrolled in Medicaid through Kynect.