Part 1 – A Little More Than a Biography

by Michael Todd Oldfield, April 9, 2018

MY EARLY YEARS IN FINANCIAL SERVICES

It occurs to me that some people would like to know more about me than a canned “bio”. And being that I love to write, I thought I would take some time to tell you about my ongoing career in financial services and a little bit about what I do for my clients.

Today I am 55 years old. Almost 56 actually. I look in the mirror and wonder; whose the old fart? It’s funny. They say that 65 is the new 50… and 50 is the new 40. I don’t know. I am happy to be 55 although sometimes I feel 65. I just want to know who the old fart is. Is that wrong?

Today I am 55 years old. Almost 56 actually. I look in the mirror and wonder; whose the old fart? It’s funny. They say that 65 is the new 50… and 50 is the new 40. I don’t know. I am happy to be 55 although sometimes I feel 65. I just want to know who the old fart is. Is that wrong?

Oh. Born and raised in Lexington, Kentucky. I proudly serve families and individuals all over the beautiful state of Kentucky.

I began my career in financial services in roughly 1981; more than 37 years ago. I was a licensed, life agent only at that point, representing a company called Security Financial, which I think was a subsidiary of PennCorp Financial. Security Financial had a very odd product called Driver’s Security; a life insurance policy that paid off only in the event the policy holder died in a car, bus, or truck accident. If desired, a policy owner could add additional riders that would cause the policy to pay off in the event they were killed in a bus accident or on a tractor. The policies only paid off in five, ten, or fifteen thousand dollar amounts. The most you could sign up for was a measly fifteen thousand dollars. Obviously the policies were very affordable. They only cost $59-$159 per year in premium depending on whether you wanted five or fifteen thousand in coverage. There was no health underwriting. Very simple to sign people up for. They definitely fit a niche market in Kentucky; being that we have a LOT of poor farmers on tractors here.

It was a fun job. I was only 18 years. EIGHTEEN! Within three months I was a manager building my own group of agents. However, being that I was so young and immature, I did not remain in the industry long however. I was only eighteen; again. I just was not ready to build a sales career as a financial adviser at that young age. I am not sure I even made it a year. But, I knew I liked the work. I liked helping people make financial decisions. I am honest and I think that comes through when I talk to people.

In October, 1987 I re-entered the industry in a big way. I was hired by Dean Witter Reynolds (now they are Morgan Stanley) to enter their broker training program. Now this was a big job. It was estimated that Dean Witter invested more than $40,000 in each trainee to teach them the business. Looking back I still cannot imagine that they chose me. Although, I definitely showed talent for the work.

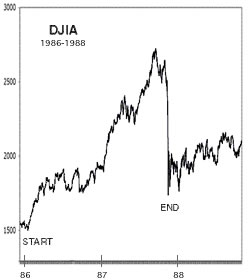

My first day was October 26, 1987 which was settlement day for “Black Monday”; the biggest one day stock market crash in history. Now, while you might think this was a terrible time to begin a career with such a prestigious organization. But, it turned out to be just the opposite. It was a perfect time to begin this career. The financial world was in shambles. Investors were lost, bewildered. Their fortunes were 1/2 gone almost; and their current broker or brokers were not returning their calls. They were scared and alone.

My first day was October 26, 1987 which was settlement day for “Black Monday”; the biggest one day stock market crash in history. Now, while you might think this was a terrible time to begin a career with such a prestigious organization. But, it turned out to be just the opposite. It was a perfect time to begin this career. The financial world was in shambles. Investors were lost, bewildered. Their fortunes were 1/2 gone almost; and their current broker or brokers were not returning their calls. They were scared and alone.

Their current investment advisers were hiding from all their calls. Wouldn’t you if you had been the adviser? Imagine for a moment, unexpectedly, in the matter of a few hours, all your clients; people that trusted you had seen a bunch of their net-worth evaporate. there was nothing you could do. If you had 1,000 clients you just could not make time to speak to them all in time. I am kind of glad that I began a week after that crash.

For a young guy with a lot of ambition, it was a perfect time to join the industry. Once I completed the in-depth four month training to get my securities license, including a month in New York City working in the World Trade Center II; All I had to do was create a list of people to call, and start calling them. I must have called 50-200 per day; easy. And signing them up as clients was not difficult. I am an honest, fun, intelligent guy trained by an excellent, leading company in the industry with excellent, conservative growth and fixed-income ideas. They loved me.

I offered great investment ideas and I helped a lot of people. My clients cooked dinner for me. They took me to antique auctions. Lunches. Racquetball matches. Horse races. I was having a blast. I learned so much. I lived the life fully and read everything I could on economics and investing. I could show seniors how to create tax-free retirement incomes above 7%. In fact, during the late-80s and early-90s it was not uncommon for seniors to be able to live on their retirement interest entirely. Boy, those day are gone forever it seems.

I held so many licenses and certifications. I was series 6, 7, 63 licensed of course. Those are the most common securities licenses. I also had my Series 23 and 24; and my life license because I loved writing Annuities. I was licensed as a commodities principal, a registered options principle, and later on licensed to be a manager of others in the industry. I was really credentialed well.

On the anniversary of my first three years in the business, out of the one hundred and six agents that begin in my initial training class in 1987, I was ranked 3rd; quite a nice recognition. I was really good at the work. I found excellent ways for my clients to make money; safely. This was very important to me. Most my clients were seniors; many were very old. They really relied on me to help them find safe vessels for their dollars. I had to help them earn the most money possible with the least amount of risk. I took my fiduciary responsibility very serious. I still do; even more so these days.

CURRENTLY…

Today, I do the same thing, but from a different angle. I am a licensed health and life agent in the state of Kentucky; and an independent broker. I don’t advise people on securities any more; only various insurance products. i have thought from time to time about re-licensing myself as a securities broker again, but the reality is; I am at a different place in my life. I am now an old guy; servicing seniors. I understand their concerns as they were my own. I am very, very conservative and risk-adverse personally.

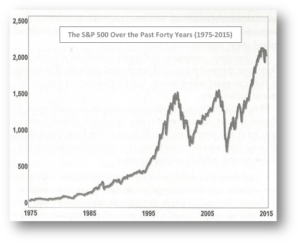

I have no confidence in the stock markets. I am not confident in our ability to make money safely in those markets. I just think the whole thing is so manipulated these days. It’s just not real I feel. There is no way that I could begin to place my own money in the markets; and risk 1/2 of it in the process; which is always the case I think. I cannot do risk for myself. I just do not have the time. I have about ten peak earning years left in me. Then it will be time to coast on into the finish line. This is my last sprint. My clients are mostly fifty to eighty years old. They cannot take risks that I cannot take. Many are much older than I am. The older we get, the less risk we can afford to take in life. We cannot shoot for big gains which require big risk. We need to know for sure what we re going to have when we retire… or else we will end up greeting better prepared seniors who are shopping our local Wal-marts. Right?

We have to be prepared. We have to plan our finances wisely so as to have the most stable retirement income possible.

And it’s getting harder and harder; what with healthcare costs shooting up, care costs being outrageous, interest rates being next to nothing; and Medicare and Social Security being one step from the chopping block. Can any of us even believe in the viability of Social Security any longer? I have said for my entire life that when it was my turn; it would be gone.

THE TAKE AWAY

At this point, I just wanted to share with you a little bit about my background and where I am today. All told, at this writing, I guess I have really about thirteen years experience in our business and have tackled it from every aspect. I love the industry. I love helping the people. My own age and personal investment strategies have been largely tied to my age at the time I was in the business. When I was younger, I did more aggressive investing tied to growing piles of money with the highest returns; sometimes taking the highest risks. But it always seemed to work out.

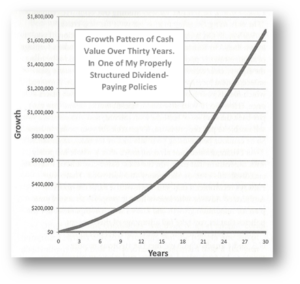

These days, I advise people in the most conservative manner and select the most conservative, safe investment options to represent. My goal is nearly always preservation of capital, with the highest guaranteed returns and the most flexibility for my clients.

As we age, we have to have a more flexible investment strategy. We just don’t know what our financial needs are going to be from year to year, or month to month even.

- Will we need hospital care?

- Will we need long-term care?

- Will we outlive our savings?

- Will we have an “income gap”?

- Will we need more or less income? What will we pay in taxes?

- What would happen to our income if we lost our partner?

- What would happen if our partner lost us?

- What will we leave for our kids?

These are all questions we have to not not only know the answer to; but we need to know how to plan for these eventualities. I guess the following pictures outline what I do these days.

Sleepless Nights for 40 Years? “Bank on Yourself” Policy owned by Pamela Yellen

“Bank on Yourself” Policy owned by Pamela Yellen

I help people find guaranteed returns, guaranteed income, with the least amount of risk and tax liability possible. In the next installment, we will talk about this focus and how I might be able to improve your sleeping habits.I don’t know. Which chart would allow you to sleep better?

Want to know more? Then read on and we can talk about the kinds of things I do for people now, and why I choose to do them; and my plans for the future.

PART 2 – Here’s What I focus on these days and why…

PART 3 – Here are my plans for the future; ok, let’s say it…. for the rest of my life.

Facebook Comments